The Pros & Cons of Renting Versus Buying a Home

Is it better to rent or buy a home? This is a question that everyone has to process through at some point in time. It’s not always best to buy and it’s certainly not always best to rent. A person’s lifestyle, financial situation, relational situation, and employment are all factors that can sway the answer to one side to the other.

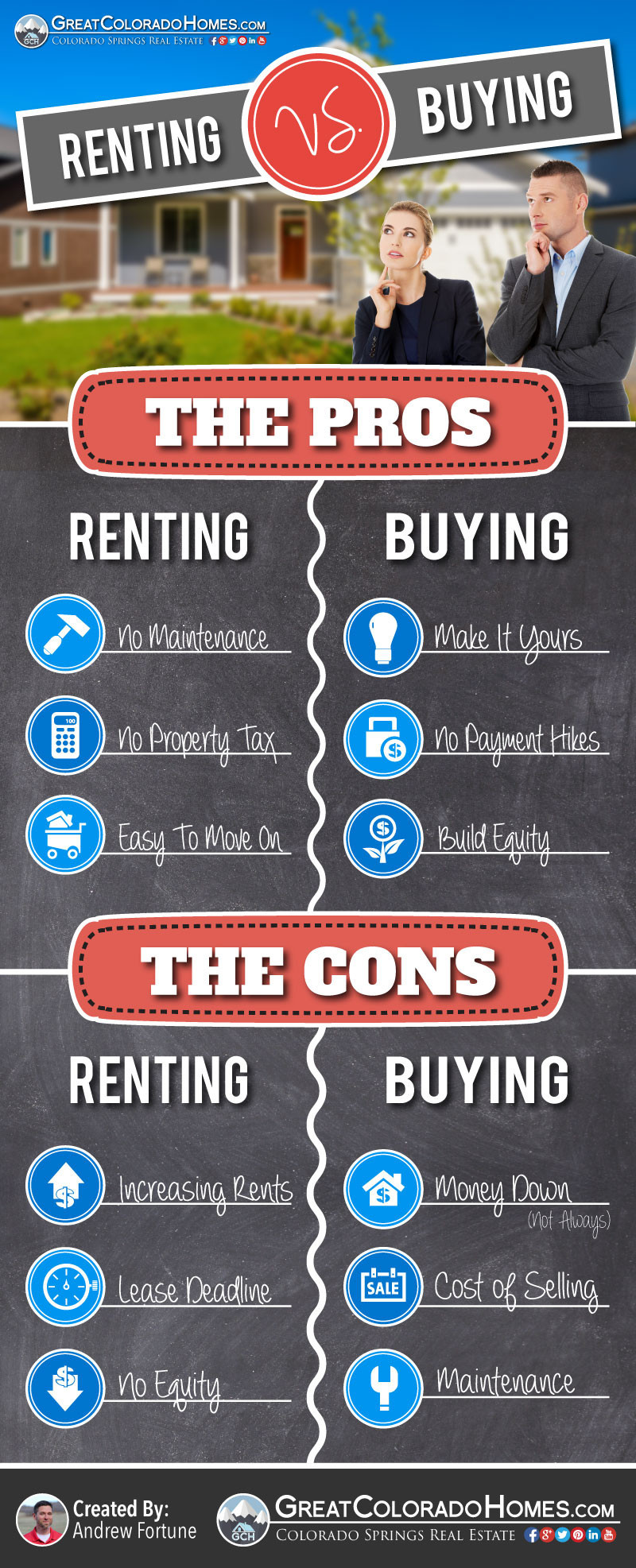

Here’s a simple infographic to help breakdown some of the pros & cons to the question:

Should You Rent or Buy a Home?

After viewing the pros and cons above, let’s look at how they apply to different areas of a persons life.

The PROS of RENTING

Easy To Move On

Easy To Move On

When you rent a home, you are free to move on as soon as your lease is expired. There’s no house to sell. This is one of the most common reasons for renting a home, rather than buying. If you are unsure of how long you will be living in an area, renting is usually your best option. Selling a home is a lot of work and expense, so it makes sense to buy a home when you are sure that you want to stay in the home for a few years. This allows you to build up equity and make money when you sell, which you cannot do when you rent.

When you rent a home, you are free to move on as soon as your lease is expired. There’s no house to sell. This is one of the most common reasons for renting a home, rather than buying. If you are unsure of how long you will be living in an area, renting is usually your best option. Selling a home is a lot of work and expense, so it makes sense to buy a home when you are sure that you want to stay in the home for a few years. This allows you to build up equity and make money when you sell, which you cannot do when you rent.

No Property Taxes

No Property Taxes

For many homeowners, property taxes are the 2nd highest cost of owning a home, next to their mortgage payment. Home owners insurance is a close 3rd for expenses, which is another fee that you do not have to pay when you rent a home…. or do you? I have heard the argument that the cost of property insurance and home owners taxes are enough to make people rent, rather than buy. But think about this, the landlord of the property that you rent is also paying property taxes and insurance. So, who is really paying the property tax and insurance? It just makes sense that the cost of the tax and insurance are being passed on to the tenant. This means that tenants are inadvertently paying the taxes and insurance for their landlord, just not directly. There are also tax advantages to owning a home as well.

No Maintenance

No Maintenance

Every home needs maintenance and repairs over time. When you rent a home, the repairs are passed on to the landlord or property management company. This is a very popular reason to rent. Of course, there are down sides to this as well. Some landlords and property management companies are not very prompt or easy to work with. Just do a quick Google search for reviews on property management companies in your area. You may find a long list of tenants who have complained that it took days or weeks to fix issues in their rental properties that should have been fixed immediately, as well as smaller issues that never got fixed at all. However, if you have a good landlord, your maintenance worries are minimal.

The PROS of BUYING

You Can Make It Yours

You Can Make It Yours

When you buy a home, you are free to paint, change fixtures, tear down walls, or put up new walls. It’s your home and you can do whatever you want with it. When you rent a home, you are not allowed to change paint colors, fixtures, or remodel. Having the freedom to do what you want with your home is one of the greatest benefits of homeownership. My wife and I have rented a home after moving to a new area and it was very hard for us to leave the house alone. Many people are like us and want to own a home for the freedom to make it the way we want it. A home is a place that captures many of our memories, which is why we want it to reflect us and our design choices.

When you buy a home, you are free to paint, change fixtures, tear down walls, or put up new walls. It’s your home and you can do whatever you want with it. When you rent a home, you are not allowed to change paint colors, fixtures, or remodel. Having the freedom to do what you want with your home is one of the greatest benefits of homeownership. My wife and I have rented a home after moving to a new area and it was very hard for us to leave the house alone. Many people are like us and want to own a home for the freedom to make it the way we want it. A home is a place that captures many of our memories, which is why we want it to reflect us and our design choices.

No Payment Hikes

No Payment Hikes

When you agree to the terms of your mortgage, chances are very high that you will have a fixed rate. This means that your mortgage payment will not increase over the life of the loan. The security of knowing your payment amount will never change is very comforting. It’s common for rental properties to have payment increases every time that the lease is resigned. Especially in areas like Denver & Seattle where rents have increased dramatically over the past few years.

Build Equity

Build Equity

When you buy a home, a portion of your payment goes straight to paying off your mortgage. Every time you make a payment, you earn equity in your home. As the price of your house appreciates, your mortgage goes down and your equity steadily rises. If you buy a home in an area that appreciates well and you pay down your mortgage over 5+ years, you will have a nice chuck of equity to use however you like. You can use your equity to move into a larger home, refinance and take out some cash, or leave it alone and let it grow!

The CONS of RENTING

Increasing Rents

Increasing Rents

Rents nationwide seem to be rising fast right now. In Colorado Springs, rents have been steadily rising for years. This makes it hard to plan your future finances when you don’t know what your rent payments are going to be after your lease expires. Once a lease is expired, a landlord can raise the rent as high as they want. If you disagree to the new terms, you’ll need to find a new place to live, which is also an expense and very exhausting. The unknown future of rents can make tenants feel insecure and unsettled.

Rents nationwide seem to be rising fast right now. In Colorado Springs, rents have been steadily rising for years. This makes it hard to plan your future finances when you don’t know what your rent payments are going to be after your lease expires. Once a lease is expired, a landlord can raise the rent as high as they want. If you disagree to the new terms, you’ll need to find a new place to live, which is also an expense and very exhausting. The unknown future of rents can make tenants feel insecure and unsettled.

Lease Deadline

Lease Deadline

When you sign a lease, it will most likely have a deadline. Many leases are structured for a year. Once the lease is up, there is no certainty that you will be able to renew. Sometimes landlords will sell the rental property after a lease is expired, or have family and/or friends move in. The future is always uncertain when you rent a home, which makes long term life plans more difficult and uncertain.

No Equity

No Equity

Every rent payment made goes straight to the land lord. You do not have any ownership or equity in the property. This is the hardest part of renting for most people. Knowing that every dollar of your rent is gone for good is discouraging and causes tenants to look into owning their own home. Rent always costs much more in the long run. Imagine renting for 10 years, as opposed to paying down a mortgage over 10 years. The person who pays down their mortgage is going to have a nice chuck of equity when they sell, as opposed to the person who rents and has no equity after 10 years.

The CONS of BUYING

Need Money For Down Payment

Need Money For Down Payment

When you buy a home, it’s common for the mortgage company to require you to put a certain amount of money into the deal as a down payment. This is usually between 3% to 5% of the cost of the home. There are down payment assistant programs and other mortgage options for certain people, so this is not always a con to owning a home. There are misconceptions that home buyers need as much as 20% down, but this is usually not the case. The best way to find out is to talk to a mortgage lender and know your options.

The Cost of Selling

The Cost of Selling

Selling a home can be costly. Realtor fees can run from 4% to 6% of the sales price of your home. If your home needs some work before selling, you’ll also have to come up with the money to make those necessary updates or repairs. Selling a home is much more stress than buying a home. It usually requires months of planning and preparation to really do it right and make the most amount of money when you sell your home.

Homeowner Responsibilities

Homeowner Responsibilities

When you own a home, it is your responsibility to maintain the property. You’ll need to work on the landscaping, have the heater & air conditioner serviced, and repair any damages to the property. Your home owners insurance will typically help you with many of the most costly issues, like roof repairs and major damages. The rest is up to you. I personally prefer this because I can fix problems, like a broken garbage disposal or ceiling fan, and replace old items with new high-end items to make my house run smoother. My dishwasher and garbage disposal are virtually silent since I replaced them recently; and I prefer to do these things myself.

THE VERDICT

Both renting and buying have their advantages and disadvantages. It really comes down to the stability of your living situation. If you have a career that is moving forward and you feel like you are going to be in your current city for a while, buying a home makes much more sense. If your life is up in the air and you don’t know what next year is going to be like, renting a home makes a lot more sense. Buying a home costs less in the long run and builds your financial situation. Renting a home is expensive and always leaves you without any true ownership or equity.

Taking the time to truly look at all the aspects of each option can help you plan your life to move in the direction that benefits you the most. If you plan on buying a home, there is a ton of information online to help you. Start with this article that explains how to buy your first house. It will give you a quick overview of the home buying process and help you identify where to start. Good luck and happy house hunting!

Hi! I'm Andrew Fortune, the founder of Great Colorado Homes and the creator of this website. I'm also a Realtor in Colorado Springs. Thank you for taking the time to read my blog post. I am always open to suggestions and ideas from our readers. You can find all my contact info here. Let me know if you need a Realtor in Colorado Springs.

Our Most Recent Blog Posts:

Here's a step-by-step guide to take you through the home-selling process.

What happens after you go "under contract" on a home?

Where are the best areas to invest in Colorado Springs?

Here are the 10 most important things to do before listing.

The complete step-by-step guide to buying a home.

Here are the most common fees to expect when buying a home.