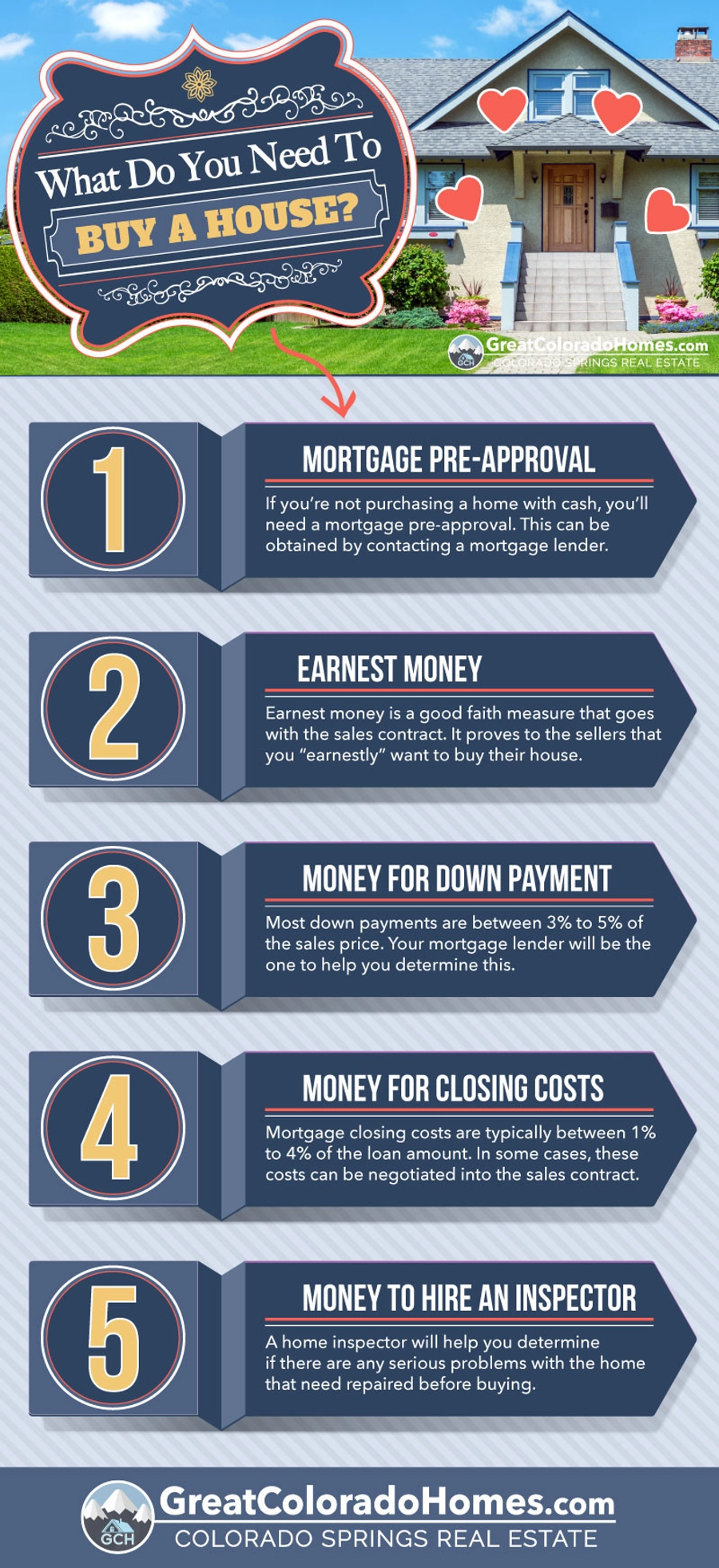

One of the most common questions is, "What do I need to buy a home?" There are so many steps involved when buying a home; it's not uncommon for first-time home buyers to completely overlook one or more of these items.

To buy a house, you typically need:

- A down payment: A portion of the purchase price you pay upfront.

- A pre-approval for a mortgage: A commitment from a lender to provide you with financing up to a certain amount based on your creditworthiness and income.

- Proof of income and employment: Documentation that verifies your ability to repay the mortgage.

- Good credit: A good credit score and history can help you get better interest rates and loan terms.

- Closing costs: Fees associated with purchasing a home, such as a title insurance, appraisal, and attorney's fees.

- A real estate agent: An Realtor can help guide you through the process and negotiate on your behalf.

This article will cover all the critical things required for most home purchases. Other requirements may come from your mortgage lender, such as the previous year's tax returns, employment verification, credit scores, etc. In this article, we'll stick with the most critical items that typically cover the money you'll need. We also created an infographic at the bottom of this post that you can save and use as a reference.

Mortgage Loan Pre-Approval

Mortgage Loan Pre-Approval

The first step in buying a home is to find the money to buy a home. For most people, that means getting a mortgage. A mortgage is the most common type of loan used to buy a house. So, how do you get a mortgage pre-approval?

There is no end to the number of places you can go online to get a mortgage pre-approval. We recommend getting a referral from a Realtor that you trust. They only work with the best lenders.

There is no end to the number of places you can go online to get a mortgage pre-approval. We recommend getting a referral from a Realtor that you trust. They only work with the best lenders.

The right mortgage lender will help you understand your borrowing options and make the whole process as easy as possible.

Once you have found a mortgage lender, they will run a credit check, ask you some questions about your current financial situation, and determine your eligibility based on these answers.

They will work with you throughout the buying process once you have found a house. They will also issue you a pre-approval letter to share with Realtors, buyers, and home builders. This letter lets everyone know that you can purchase a home within the price range the lender recommends.

Earnest Money

Earnest Money

.png) Earnest money is money you must provide upfront when buying a house. Think of earnest money as your way of saying, "I EARNESTLY want to buy your house, so I am putting this money with my offer." It's like a deposit to prove you are serious about purchasing the seller's home.

Earnest money is money you must provide upfront when buying a house. Think of earnest money as your way of saying, "I EARNESTLY want to buy your house, so I am putting this money with my offer." It's like a deposit to prove you are serious about purchasing the seller's home.

In Colorado Springs, the earnest money is usually around 1% of the home's purchase price. If all goes well and you get to the closing table with the seller, that money is credited back to you at closing.

If you terminate your sales contract within your inspection or loan objection deadlines, you will typically receive your earnest money back. If you are past those dates, getting your earnest money back is much harder. Earnest money is usually held by the title company or listing agent's office.

Money for Down Payment

Money for Down Payment

Once you talk to a mortgage lender about your pre-approval, they can tell you what amount you need as a down payment to purchase a home.

Once you talk to a mortgage lender about your pre-approval, they can tell you what amount you need as a down payment to purchase a home.

Different loan types, like VA loans or USDA loans, do not require a down payment and offer 100% financing. You will need to check with your loan officer to determine if you are eligible for this type of loan product.

The most common downpayment required is usually between 3% and 5% of the purchase price. Some lenders will require a 20% down payment if you already own a home and want to purchase a second one.

In Colorado, most loans above $800,000 will require a minimum down payment amount of 10% down. There are many different options available that your lender will help you navigate. Contact us if you need a recommendation for an excellent local loan officer.

Money for Closing Costs

Money for Closing Costs

When you purchase a home with a mortgage, your mortgage company will charge fees for originating and generating your loan.

When you purchase a home with a mortgage, your mortgage company will charge fees for originating and generating your loan.

These can be anywhere from 1% to 4% of the loan amount, depending on your loan type. Talk to your loan officer to get a reasonable estimate of what yourclosing costs might be for your loan type.

When you write the purchase contract, it is also possible to ask the seller to contribute to your closing costs. This option will depend upon the market you are in and the demand for homes in your price range.

If homes are selling in a day or two in your area, it's challenging to get a seller to agree to offer money towards your closing costs. I typically advise saving that money just in case you find the perfect house, but the seller will not provide any closing cost assistance.

Money To Hire A Home Inspector

Money To Hire A Home Inspector

Once you have found a home and have an executed contract with the sellers, you'll need to hire a home inspector. In Colorado, we usually write a 7 to 10-day inspection period that allows enough time for homebuyers to hire a home inspector to ensure no significant issues with the home.

Once you have found a home and have an executed contract with the sellers, you'll need to hire a home inspector. In Colorado, we usually write a 7 to 10-day inspection period that allows enough time for homebuyers to hire a home inspector to ensure no significant issues with the home.

The average cost of a home inspection can be from $350 to $600+, depending on the size of the home. Depending on the property you purchase, you may also consider hiring radon, septic, well, structural, mold, pest, or methamphetamine inspection.

Your real estate agent will advise you on these options and help you determine the extra expense of these additional inspections. If you require multiple inspections, make sure that you write enough time into your Inspection Deadline to complete them all.

Final Thoughts

Buying a home is a huge commitment. It's not like buying any other item. You can't take it back later if you have buyer's remorse. For this reason, it's wise to research as much as possible before buying a home.

Research your loan officer and Realtor online before committing to work with them. If you are skeptical, then find a new professional to work with. Don't move forward until you have the proper pieces in place. Once you have the five things taken care of, an adequate loan officer and a realtor, you're ready to buy a house.

Your Realtor is your most valuable asset when buying a home. They can help you with the five steps above and help guide you through the buying process. They are your "go-to" contact for almost every question.

If you are feeling intimidated by the process, let your agent know. You should feel like you are entirely informed of all your options and have an advocate in your corner who fights for you when you need them to.

An excellent Realtor will make the complicated process of buying a house feel like a simple transaction. They do a lot of work behind the scenes, so be sure to thank them when they do an excellent job for you.

Now that you are prepared for these five critical things you need to purchase a home, you can be sure that you have what it takes to get into the home of your dreams. Happy house hunting!

.png)

.png)