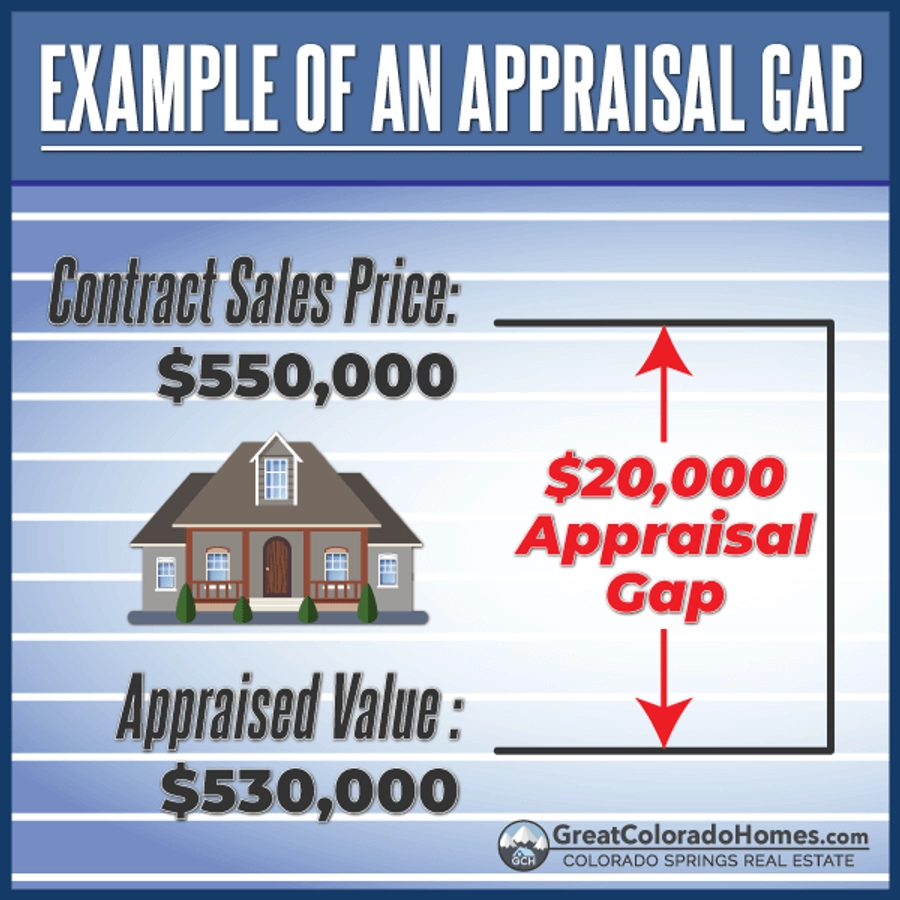

What is an appraisal gap? An "appraisal gap" happens when a home's appraised value is lower than the price agreed upon in the sales contract. To address this, an "appraisal gap clause" is included in the agreement, ensuring the buyer agrees to cover the difference between the appraised value and the purchase price if needed. Let’s walk through how this works below.

You're not alone if you've ever wondered what happens when the appraisal comes in lower than the purchase price. That's where an appraisal gap clause comes into play. It’s a simple, important addition to the purchase contract that helps bridge the gap between the appraised value and the agreed-upon price. Essentially, this clause means you, as the buyer, agree to cover the difference, up to a set amount. Think of it as a middle ground between having an appraisal contingency and waiving it altogether. In this post, we'll dive deeper into an appraisal gap clause, how it works, and why it could be a helpful tool in today's real estate market.

This infographic explains an appraisal gap:

To fully understand appraisal gaps, we must discuss the appraisal basics.

Table of Contents

- What is an appraisal in real estate?

- How does a real estate appraiser determine value?

- What is an appraisal contingency?

- How does an appraisal gap guarantee clause work?

- When is an appraisal gap clause helpful?

- How do you write appraisal gap coverage into a real estate contract?

- What other tactics are used to get a contract accepted?

What Is An Appraisal in Real Estate?

An appraisal is a professional estimate of a home's value provided by a licensed real estate appraiser. Mortgage lenders typically require appraisals for various loan types, including home purchase loans, refinancing, and HELOCs (Home Equity Line of Credit), among others.

Every time a buyer and seller agree on a home sale, they settle on a purchase price. The bank, in turn, agrees to lend the buyer money in the form of a mortgage loan, as long as the property appraises at or near that price.

To make sure they're not lending too much for a home that might not be worth the agreed price, banks hire licensed appraisers to give their expert opinion on the home's value.

However, appraisals aren’t always an exact science. Since they’re based on an appraiser's opinion, there can be some room for variation. If you hired three different appraisers for a refinance, you could end up with three slightly different estimates. This can be the same for a VA loan, USDA loans, conventional, or any refi and HELOC.

How Does a Real Estate Appraiser Determine Appraised Value?

A real estate appraiser is a trained expert who helps determine what a property is worth in today’s market. When they do an appraisal, they create a detailed report that breaks down how they arrived at their estimate, giving you a clear picture of the home’s value.

A real estate appraiser is a trained expert who helps determine what a property is worth in today’s market. When they do an appraisal, they create a detailed report that breaks down how they arrived at their estimate, giving you a clear picture of the home’s value.

Appraisers rely on recently sold homes, often called "comps" or "comparables" by Realtors, to figure out a home's value. They carefully analyze details from each similar property and use that information to come up with an estimate of what the home is worth.

After a home is under contract and the inspection is complete, the next step is the appraisal, which is ordered by your mortgage lender. The appraiser will visit the property, do a walk-through, and take photos of the home.

From there, they 'll compare your home's features with similar homes that have recently sold in the same neighborhood. Once they’ve gathered all the info, they’ll put together a detailed appraisal report, which helps the lender determine the home's value.

In a hot real estate market, appraisers are often caught in the middle, trying to make sense of some eye-popping sales contracts that listing agents bring to the table. Their job is to protect the bank from lending too much while also helping buyers keep their deals on track. It’s a tough balancing act, especially in unpredictable markets.

Appraisers play a crucial role in ensuring lenders stay within safe loan limits, but it’s no easy task when prices are soaring and competition is fierce. This tension is one of the trickiest aspects of a real estate transaction.

What is An Appraisal Contingency?

Most real estate contracts include an "appraisal contingency," which gives the buyer and lender a way out if the home doesn't appraise for the agreed-upon price.

Take the example mentioned earlier: if a home appraises for $20,000 less than the sales price in the contract, the lender will typically only finance up to that appraised amount. That leaves the buyer or seller needing to make up the difference to keep the deal moving forward.

When a home doesn’t appraise for the contract price, it can create a real roadblock, and sometimes deals can fall through because of it. This is why it’s crucial for both buyers and sellers to understand this potential issue before signing a contract.

How Does An Appraisal Gap Guarantee Clause Work?

When a home appraises for less than the contract price, the difference, known as the appraisal gap, has to be addressed before the deal can move forward. Without a solution, the transaction can’t proceed.

That’s where an appraisal gap clause comes in. This clause means the buyer agrees to cover the gap between the appraised value and the contract price.

For example, as we mentioned earlier, the buyer might need to bring an extra $20,000 to the closing table. By including an appraisal gap clause for that amount (or more), it automatically ensures everything is covered if the appraisal comes in low.

In short, appraisal gap coverage reassures the seller that the buyer will take care of the difference, helping to keep the deal on track.

When is an Appraisal Gap Clause Helpful?

A "seller's market" is when homes are in high demand and often sell fast, sometimes within days. In this type of market, it’s common to see bidding wars where buyers compete by offering more than the listing price.

The challenge for appraisers in these situations is figuring out the actual market value. Sometimes, the sales data doesn’t match the high prices buyers are willing to pay. This is where an appraisal gap clause can come in handy. It helps protect the seller from losing money if the home’s appraisal comes in lower than expected.

When buyer demand drives prices above the fair market value, sellers risk losing out during the appraisal. But buyers who have extra cash to cover the gap usually come out on top in these competitive, multiple-offer situations.

How Do You Write Appraisal Gap Coverage Into a Real Estate Contract?

There are several ways to include appraisal gaps coverage in a real estate contract, and your Realtor will be a great resource in guiding you through the process.

The most important part to focus on is the dollar amount you're comfortable covering. Offering an open-ended guarantee to cover the gap between the appraised value and the sales price is risky. Instead, it’s best to set a clear limit on how much you’re willing to pay. That way, you protect yourself from any surprises while still making a strong offer.

Here's an example of an appraisal gap clause that can be written into the purchase agreement:

"If the property does not appraise for the purchase price, the buyer agrees to pay up to $20,000.00 above the appraised value, but not to exceed the purchase price."

The wording above should take care of the appraisal gap mentioned in the example at the beginning of this post. Keep in mind, there are plenty of ways to phrase this clause. Your real estate agent will customize the appraisal gaps guarantee to fit your specific situation and ensure it meets your needs.

What other tactics are used to get a contract accepted?

Real estate agents have had to get pretty creative with their offers in the last few years, creating new options to structure sales contracts. After the COVID pandemic, housing inventory hit record lows, making it challenging for buyers to find homes. With so many people competing, some homes were getting over 50 offers!

Agents started using strategies like escalation clauses, quick closing dates, and even tripling the earnest money to stand out. If you're curious about these tactics and want to know more, check out our blog post. We cover 18 clever ways to make your offer stand out in a competitive seller's market.

As mortgage rates rose and new opportunities emerged, the real estate market started to even out. In a more balanced market, knowing creative ways to structure a real estate contract can give you an edge, especially if you find yourself competing with another buyer for the same property. Understanding these strategies could make all the difference in your home-buying journey.

Frequently Asked Questions (FAQs) about Appraisal Gap Clauses

1. How much should I agree to cover in an appraisal gap clause?

The amount you agree to cover depends on your financial situation and comfort level. It’s essential to discuss this with your real estate agent and ensure you only commit to an amount you can afford. Setting a clear limit, rather than offering to cover the entire gap, protects you from overextending financially.

2. What happens if I can’t cover the appraisal gap price?

If you can't cover the appraisal gap and there’s no clause in place, you may have to renegotiate the purchase price with the seller or walk away from the deal if the lender won’t approve the full loan amount. This is why appraisal gap clauses can be helpful; they provide a predetermined solution to avoid these situations.

3. Does an appraisal gap clause affect my mortgage loan?

Yes, it can. Lenders will only finance the appraised value of the home, so if there's a gap, you’ll need to pay the difference out of pocket. This could impact your cash reserves and how much you need to save for closing costs and other expenses.

4. Can the seller help cover the appraisal gap on their home?

In some cases, a seller may agree to lower the price if the appraisal comes in significantly lower, especially if they’re eager to close the deal. However, this isn’t guaranteed, and an appraisal gap clause is often used to reassure the seller that the buyer is committed, even if the appraisal falls short.

5. Do adding an appraisal gap clause to my offer increase the likelihood of winning a bidding war?

Yes, including an appraisal gap clause can make your offer more appealing to sellers, especially in a competitive market. It shows the seller that you’re serious about closing the deal, even if the appraisal comes in lower than expected.

These common questions can help guide you through the process and ensure you understand how appraisal gap clauses work, so you feel confident in your home-buying journey.

.png)