So, you’ve had your offer accepted on a home. Congratulations! But if you thought the hard part was over, think again. Navigating the home buying or selling process without making mistakes (or losing your sanity) can be tough. You've already put in a lot of time and effort between getting pre-approved for your loan, finding the perfect home, and crafting a competitive offer.

However, signing the sales contract is just the start. There’s still plenty to do before closing day, and that’s when most people start asking, "What happens next?" This is where a checklist can be a lifesaver. It keeps you organized and ensures you're fully prepared to close the deal, without any unnecessary headaches along the way.

Missing just one of these steps can delay your closing or even jeopardize the entire home purchase. Real estate agents put in a lot of effort to make sure everything stays on track, but it’s helpful for you to stay informed, too. Use this checklist to stay in the loop and help keep things moving smoothly, so you can avoid any unexpected delays.

DEPOSIT EARNEST MONEY

DEPOSIT EARNEST MONEY

Earnest money is the buyer’s way of showing they’re serious about purchasing the home. This step happens early in the process and helps protect the seller's interests by giving them confidence as they take the home off the market.

In Colorado, earnest money is usually around 1% of the home's purchase price, but there's no set rule; it can vary depending on the local market. Some states also have a due diligence fee on top of earnest money. Once paid, the money is held in escrow until the sale is finalized.

Some Realtors collect earnest money before submitting an offer, while others arrange for it after a signed sales contract is in place. No matter the situation, it's important to ensure the earnest money is submitted on time and in the correct form, as outlined in the contract. Always double-check the details to stay on track.

PERFORM PROPERTY INSPECTIONS

PERFORM PROPERTY INSPECTIONS

Once your sales contract is signed, the inspection period begins, and the clock is ticking. It’s time to hire a home inspector to give your new home a thorough review, so be sure to schedule your inspections promptly to stay on track.

Keep in mind, depending on the type of home you’re buying, you might need more than just a standard home inspection. Additional inspections could include checks for radon, pests, septic systems, sewer lines, structural integrity, HVAC systems, meth contamination, or mold.

It’s a good idea to chat with your real estate agent about all the inspection options available. Make sure you address any inspection-related issues within the time frame laid out in your contract to avoid delays or complications.

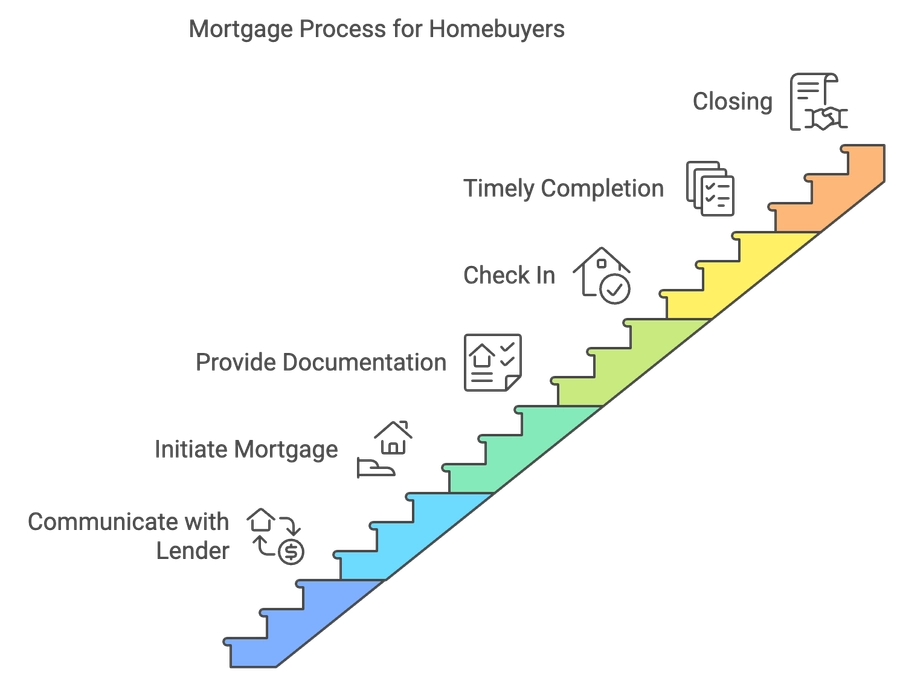

SUBMIT LENDER DOCUMENTS

SUBMIT LENDER DOCUMENTS

Once you’ve signed a sales contract for a home, it’s time to connect with your mortgage lender. This is a key step to make sure they have everything they need to get started on your loan. They'll kick off the mortgage process as soon as they receive the contract.

From there, be ready to hand over quite a bit of paperwork. It can feel like a lot, but staying organized and getting documents to your lender quickly is crucial to keeping things on track. Delays in providing paperwork can create setbacks, so the sooner you send what’s needed, the smoother your closing will go.

Some lenders may not always keep you in the loop, so checking in and confirming they’re on schedule is a good idea.

If the loan isn’t finalized on time, your contract could be at risk. Missing the closing date might allow the seller to cancel the deal and keep your earnest money. To avoid this, make sure you’re staying ahead of any document requests from your lender and responding promptly. Being proactive will help ensure a successful closing.

REVIEW THE TITLE COMMITMENT

REVIEW THE TITLE COMMITMENT

This step is usually managed by the Title Company or law office handling your transaction. They’ll issue a Title Commitment, which checks the property's title history (also known as the chain of title) and uncovers any liens that need to be taken care of before closing.

Because the title commitment rarely impacts the loan process, it’s often overlooked. In fact, people tend to pay attention to it only when an issue pops up. The most common mistake? Simply ignoring the title commitment altogether.

Make sure to review your title commitment carefully, and if anything seems off, don’t hesitate to ask an attorney for advice. Most title commitments are straightforward and won’t require any extra effort from you, but it's always smart to double-check before moving on to the next step.

ORDER THE APPRAISAL

ORDER THE APPRAISAL

Once you’ve made it through the inspection process, it's time to let your mortgage lender know. At this point, they’ll order a home appraisal to ensure the property’s value matches the loan amount stated in the sales contract.

It’s important to understand that appraisals can sometimes come in lower than the sales price. This part of the process is crucial because it protects banks from lending more than a home is truly worth. In fact, poor appraisal practices were one of the factors behind the 2008 real estate market crash when banks were giving out loans that exceeded the value of the homes. Since then, new regulations have been put in place to ensure appraisers work independently from mortgage companies.

In Colorado, appraisers have ten business days from the order date to complete the appraisal, so it's key to have your lender get the ball rolling on this as soon as possible.

Keep in mind that, as the homebuyer, you’ll likely be responsible for paying for the appraisal. It’s a good idea to wait until you and the seller have resolved any inspection issues before moving forward with the appraisal order to avoid unnecessary costs.

ORDER HOME OWNERS INSURANCE & WARRANTIES

ORDER HOME OWNERS INSURANCE & WARRANTIES

Before you can close on your new home, the mortgage lender will require you to have a Homeowner's Insurance Policy in place. This means you'll need to shop around and find an insurance provider and policy that best fits your needs.

With so many options out there, prices and coverage can vary a lot, so it's a good idea to get quotes from at least three different companies. Don't forget to compare the big national insurers with smaller local agencies; you might be surprised by the differences.

In addition to homeowner’s insurance, you may also want to consider a home warranty. These are sometimes included in real estate transactions, with sellers occasionally offering a credit for the buyer to purchase one.

Just like with insurance, it’s worth doing your homework and finding a home warranty provider that matches what you’re looking for. Once you’ve made your choice, simply let the title company know which provider you’ve selected.

TURN ON UTILITIES & WATER

TURN ON UTILITIES & WATER

With so much going on during a home purchase, it’s easy to overlook the basics, like setting up your utilities. In some states, sellers are required to provide details about local utility providers in the Seller's Disclosure, but it's still a good idea to reach out to those providers right away to get everything scheduled or transferred into your name.

If you're buying a home in a rural area, don’t forget to check the local internet speeds before making an offer. Some neighborhoods, especially those on the outskirts of town, may not have high-speed internet available.

And keep in mind, during busier months (usually summer), it's best to schedule your utilities at least a week before your closing date. The sooner you set them up, the smoother your move will be!

SCHEDULE YOUR CLOSING DATE & TIME

SCHEDULE YOUR CLOSING DATE & TIME

Your sales contract will include an agreed-upon closing date, but it's important to plan ahead to make sure everything goes smoothly. Be sure to have someone reach out to the title company well in advance to confirm they have a convenient time available. This is especially crucial during the busy summer months when title companies tend to fill up quickly. It’s a good idea to schedule your closing at least a week or two beforehand.

Typically, both the buyer and seller will attend the closing together, but in some cases, a notary or mobile closer can meet either party remotely. Your Realtor will work with the other agent to coordinate these details.

While this step seems simple, it’s often overlooked until the last minute. Save yourself some stress and make sure the title company can accommodate your preferred date and time early on.

PERFORM THE FINAL WALKTHROUGH

PERFORM THE FINAL WALKTHROUGH

It's always a smart move for the homebuyer to do a Final Walkthrough before closing on a home. This is your chance to make sure that any agreed-upon repairs have been completed and that the seller has removed all of their personal belongings. You want to ensure the home is move-in ready.

Keep in mind, the Final Walkthrough isn’t the time to renegotiate anything in the sales contract, it’s more of a last check to confirm there are no major issues that could jeopardize the sale. Small things, like a burned-out light bulb, shouldn’t hold up your closing. The walkthrough is just a safeguard to avoid any surprises that could lead to bigger problems or delays.

CLOSE THE TRANSACTION

CLOSE THE TRANSACTION

On closing day, be sure to bring your approved photo ID and any certified funds if needed. The amount you need to bring, if any, will be listed on your closing statement. You’ll meet at the title company to sign all the necessary paperwork.

Closings typically take less than an hour. If you’re financing the home, be prepared to sign the bulk of the documents. The deal is officially done once everything is signed and your lender has funded the loan.

Frequently Asked Questions (FAQs) Once You Have an Accepted Offer

1. How long does the home inspection process take?

Typically, home inspections should be scheduled and completed within 7-10 days of the contract being signed, but this timeline can vary based on your contract and local market conditions. The actual inspection usually takes a few hours, but you’ll want to allow time for any additional inspections (e.g., radon, pests) if needed.

2. What happens if the appraisal comes in lower than the purchase price?

If the appraisal comes in lower than the agreed-upon price, you may need to renegotiate with the seller or cover the difference yourself, especially if you have an appraisal gap clause. Without one, you could back out of the contract or adjust your loan amount, depending on your lender’s terms.

3. When should I shop for homeowners' insurance?

You should start shopping for homeowners' insurance as soon as your contract is signed. Your lender will require proof of insurance before closing, so it’s important to compare policies early and find one that meets your needs. Be sure to provide the policy details to your lender and title company.

4. Can I change my mind after the final walkthrough?

The final walkthrough is your last chance to confirm that the home is in the agreed-upon condition and that any repairs have been completed. While it’s not a time to renegotiate, if you find significant issues, you may be able to delay closing or request a solution from the seller. Minor issues, like a missing lightbulb, should not hold up the process.

5. What should I bring to the closing?

For the closing, you’ll need a government-issued photo ID and any certified funds required for closing costs, which will be detailed in your closing statement. Be sure to confirm the amount with your title company beforehand. If you’re financing, you’ll also need to be prepared to sign a significant amount of paperwork related to your loan.

6. What if my Realtor or lender becomes unresponsive after the contract is signed?

If you feel your Realtor or lender isn’t staying on top of the process, don’t hesitate to step in and communicate directly with the title company and your lender. Being proactive will help ensure nothing falls through the cracks and that your closing happens on time.

7. What happens if my loan isn’t approved by the closing date?

If your loan approval is delayed, it can jeopardize your contract. Be sure to stay in constant communication with your lender and promptly provide any requested documents. If a delay seems likely, your Realtor may be able to negotiate an extension with the seller, but this is not guaranteed, and it’s best to avoid delays by staying organized.

8. Can a seller back out after they have accepted my offer?

Yes, a seller can back out after accepting your offer, but only under certain conditions outlined in the contract, such as contingencies or buyer breaches. However, if the seller tries to back out without a valid reason, they could face legal consequences or be required to compensate the buyer. It's important to review your contract and consult with your Realtor or attorney if this situation arises.

.png)

.png)

.png)